The state of real estate

The housing market appears to be on a steady recovery track since its crash in late 2006, and "homes prices are 5 percent off of the historical normal," according to Sean Aggarwal, chief financial officer of residential real estate website Trulia.

In 2013 the housing market was up big—11.3 percent—according to theCase-Shiller Home Price Indices, making it the best year since 2005. Las Vegas, Los Angeles and San Francisco had the largest boosts last year, up more than 20 percent. Though this year, projections are not expect to shoot through the roof like last year. The research firm Clear Capital, which serves the mortgage and lending industry, projects that in 2014 home prices will rise between 3 and 5 percent.

This spring's selling season looks to be an attractive one, according to Wells Fargo chief financial officer Tim Sloan, who recently said on CNBC's "Squawk Box" that home affordability continues to be "very attractive."

Given last years stellar rise and this years projected growth, which is more in line with historical norms, near-retirees might be considering exiting the market in the near future in case home prices reverse course. It's the age old dilemma of getting out now or staying in the game, as homes come with a level of risk, just like any other asset.

One reason home sales might not continue to climb as they did last year is rising interest rates—the main driver for this being the Fed's likely move to continue tapering.

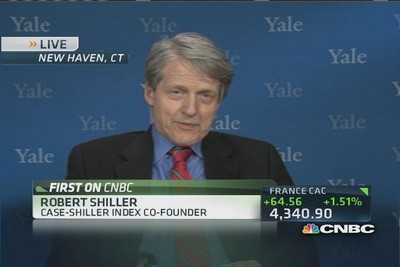

Despite prices still being up year–over–year, this week's Standard & Poor's/Case-Shiller 20-city home price index showed a dip in January—the third month in a row. This was mainly due to a perfect storm of a brutal winter, low inventory and rising interest rates. Despite the fact that the index dropped just .01 percent for the last 3 months, Yale economics professor and co–founder of the index Robert Shiller did say on this week's "Squawk on the Street" that the market is "gradually slowing...according to the data we have".

Also, this week's U.S. Department of Commerce report showed that new home sales in February were down both 3.3 percent from January and 1.1 percent from a year ago .

Robert Shiller: Housing could weaken more

Robert Shiller, Case-Shiller Index co-founder and Yale University professor of economics, breaks down today's key housing data and explains how investors can dictate housing momentum.